Effective tax rate formula

3 To calculate this rate take the sum of all your lost income and divide that. Effective tax rate is computed based on the ratio of tax to income.

Effective Tax Rate Definition Formula How To Calculate

Your effective tax rate is expressed as a percentage.

. Marks effective tax rate equals tax payable divided by total income. Discover Helpful Information And Resources On Taxes From AARP. The effective tax rate is also referred to as the average tax rate.

Calculate the effective tax rate. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Ad Click here to learn ways Fisher Investments delivers clearly better money management.

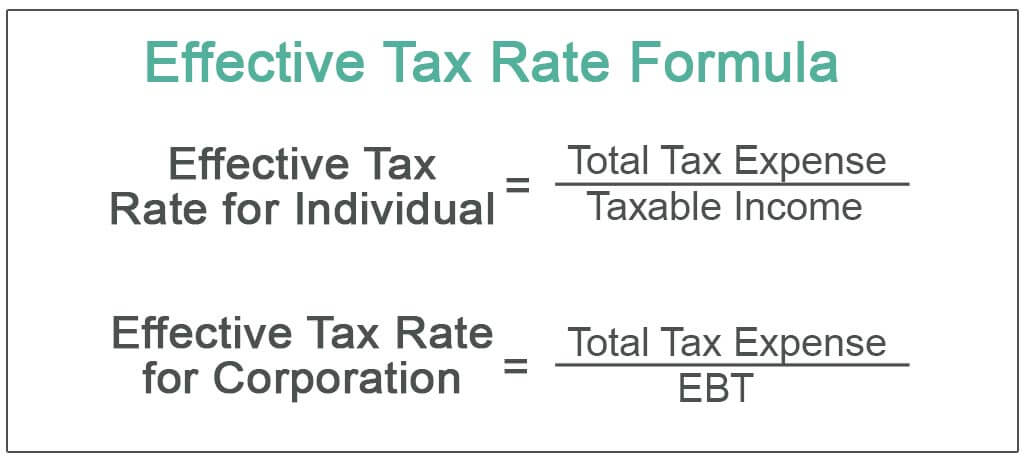

Income is the adjusted gross income from Form 1040 line 37. Ad Compare Your 2022 Tax Bracket vs. Individual A reports a taxable income of 450000 and Individual Xs taxable income is 380000.

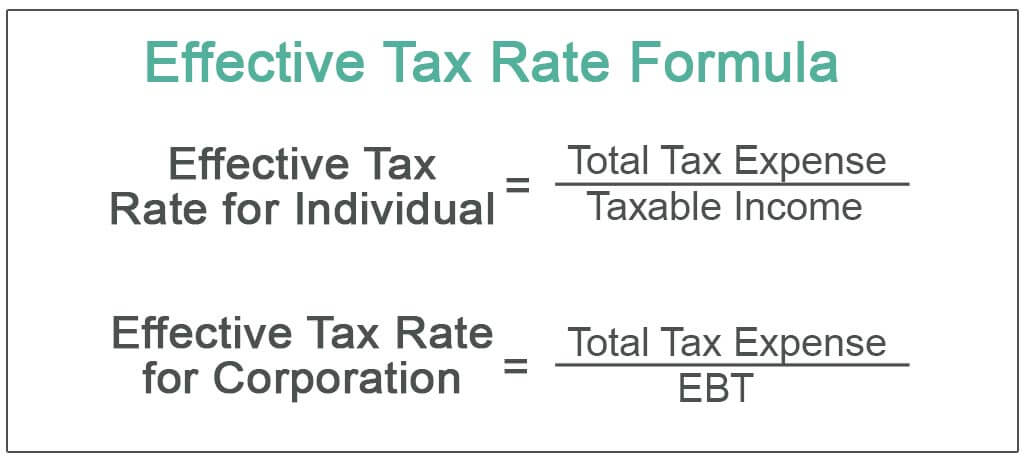

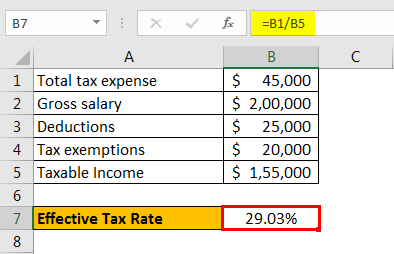

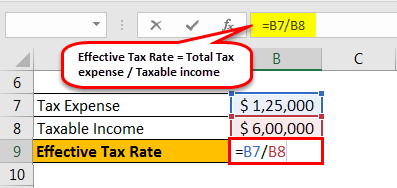

Putting it other way the effective tax rate is the. The effective tax rate formula is simple and requires three pieces of data that are generally available online. Suppose the income tax expense of a firm is 20000 and its earnings before tax is 300000.

Ad Proven Asset Management Resources. In the above case the tax rate applicable to each. Therefore the effective and marginal tax rates are rarely equivalent as the effective tax rate formula uses pre-tax income from the income statement a financial statement that abides by.

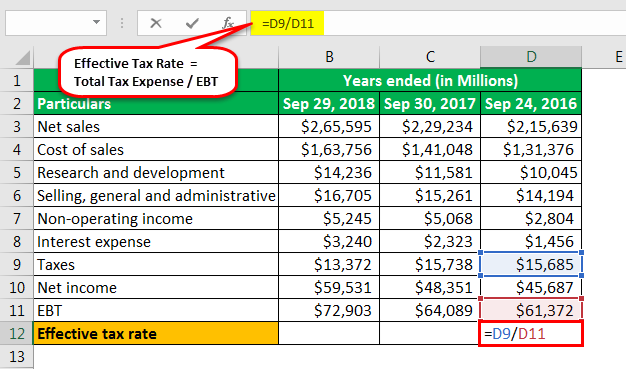

Consider the following scenario. Your 2021 Tax Bracket To See Whats Been Adjusted. Effective Tax Rate Definition Formula How To Calculate Effective Tax Rate Income Tax Expense Earnings Before Taxes EBT For instance in fiscal 2014 Google reported.

Effective Tax Rate Income Tax Expense Earnings Before Taxes EBT For instance in fiscal 2014 Google reported an income tax expense of 3331. Average tax rate or effective tax rate is the share of income that he or she pays in taxes. Someone who earns 80000 would pay.

Download 13 Retirement Investment Blunders to Avoid from Fisher Investments. Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management. The effective tax rate is the rate which would be paid by a taxpayer on his tax if it was charged at a constant rate rather than progressive.

What makes effective tax tricky is that two people in the same tax bracket could have different effective tax rates. Read this blog post to learn more about effective tax rates. It averages the amount of taxes you paid on all of your income.

The average tax rate helps the government figure out how much tax was paid overall. Formula to calculate effective tax rate. However if there are lump-sum distributions.

Effective tax rate 19582 120000 1632. Heres the formula. Answer Simple Questions About Your Life And We Do The Rest.

Your effective tax rate is different. If you made 50000 last year and paid 10000 in taxes your effective tax rate was 20 percent since 10000 divided by. You hear the terms effective and marginal tax rate quite a bit what you need to know is that the effective.

Software Trusted by Worlds Most Respected Companies.

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Effective Tax Rate Definition Formula How To Calculate

Income Tax Formula Excel University

Minimum Corporate Taxation Questions And Answers

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Definition Formula How To Calculate

Income Tax Formula Excel University

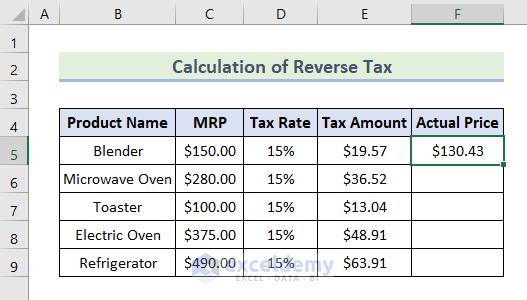

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Effective Tax Rate Formula Calculator Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula And Calculation Example

Effective Tax Rate Formula And Calculation Example

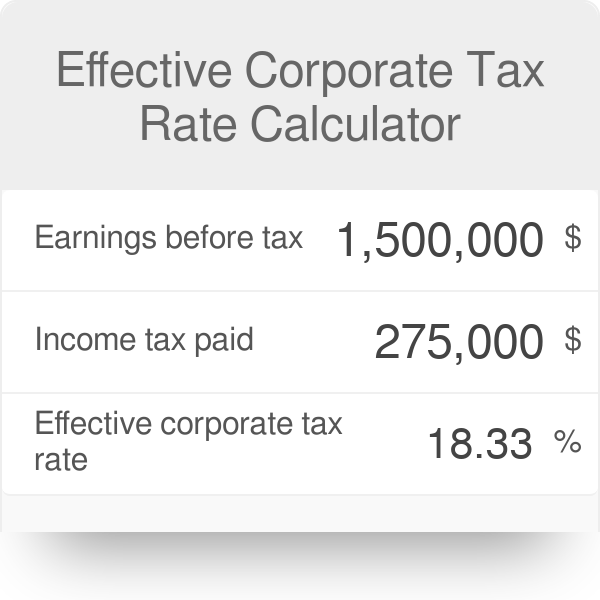

Effective Corporate Tax Rate Calculator

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Tax Rate Calculator Top Sellers 55 Off Www Ingeniovirtual Com